18,000 Dealerships Hit, 5.6 Million Customers Exposed—What You Need to Know

If you're in the automotive dealership industry, you need to read this carefully. The 700Credit data breach of 2025 isn't just another cybersecurity headline—it could directly impact your business, your customers, and your compliance standing RIGHT NOW.

⚠️ The Numbers Are Staggering:

What Actually Happened?

According to 700Credit Managing Director Ken Hill, this wasn't a traditional ransomware attack—it was something potentially more insidious.

📅 The Timeline:

- July 2025: One of 700Credit's 200+ integration partners was breached.

- May 25 - October 25, 2025: Using the compromised partner's credentials, attackers hammered a 700Credit API with millions of automated requests, systematically extracting consumer data.

- October 25, 2025: 700Credit discovered suspicious activity within its 700Dealer.com web application.

- November 16, 2025: The data breach monitoring site DataBreach.io broke the news after finding consumer data listed on the dark web.

- December 2025: 700Credit confirmed the breach and began the notification process.

The Critical Vulnerability

Here's what made this breach so devastating:

The compromised API had a CRITICAL DESIGN FLAW —given any valid consumer reference ID, it would return complete customer data (names, addresses, SSNs) WITHOUT VERIFYING that the ID belonged to the requesting account.

Think about that: Attackers didn't need to break into 700Credit's production systems. They simply exploited a partner's compromised access to systematically request millions of customer records through a legitimate—but poorly secured—API.

"They never got access to our production systems," Hill explained. "They never installed any software. This isn't ransomware."

But here's the problem: That doesn't make it any less dangerous for dealerships and their customers.

What Data Was Compromised?

The exposed information includes the trifecta of identity theft risk:

- ✅ Full names

- ✅ Complete addresses

- ✅ Social Security numbers

This combination is particularly dangerous because it was stored and transmitted UNENCRYPTED —which triggers mandatory breach notification requirements under virtually all state data breach laws.

If You're a 700Credit Customer: TAKE ACTION NOW

Immediate Steps (This Week):

1. CONTACT 700CREDIT IMMEDIATELY

Phone:

(866) 273-0345

Website:

www.700credit.com

Confirm whether YOUR dealership and customers were affected and get the specific number of your affected customers.

2. UNDERSTAND YOUR OPTIONS

700Credit committed to handling notifications on dealers' behalf, UNLESS dealers opted out by December 5, 2025, at 5:00 PM ET.

If you missed that deadline, you need to verify:

- What notifications 700Credit is sending

- Which customers are affected

- What states they reside in

- Whether 700Credit's notices satisfy YOUR state-specific requirements

3. REQUEST CRITICAL INFORMATION

Get from 700Credit:

- ✅ Complete list of affected customers

- ✅ State(s) of residence for each customer

- ✅ Written confirmation that their notices satisfy all applicable state and federal requirements

- ✅ Copies of the actual consumer notices being sent

4. NOTIFY YOUR INSURANCE CARRIER

Call your cyber insurance provider IMMEDIATELY. Document:

- Date you became aware of the breach

- Number of affected customers

- Types of data exposed

- Actions taken to respond

TIMING MATTERS when filing claims—delays can jeopardize coverage.

Your Compliance Obligations Don't Go Away

Even though 700Credit has committed to handling notifications, YOU STILL HAVE LEGAL OBLIGATIONS:

Federal Requirements:

FTC SAFEGUARDS RULE NOTIFICATION

- 700Credit filed a consolidated breach notice with the FTC listing all affected dealers

- Your dealership name will appear on a PUBLIC-FACING FTC WEBSITE

- If 500+ consumers affected: mandatory reporting (700Credit handling unless you opted out)

State Requirements:

Each state has different notification requirements. Some critical ones:

- CALIFORNIA (CCPA): Specific notice format requirements

- NEW YORK: Notify Attorney General for breaches affecting NY residents

- MASSACHUSETTS: Written notice to AG and Director of Consumer Affairs

- CONNECTICUT, MAINE, NORTH CAROLINA: Additional specific requirements

THE PROBLEM: A generic national notice may not satisfy state-specific requirements. You need WRITTEN CONFIRMATION from 700Credit that they're meeting YOUR obligations.

What 700Credit Is Doing

To their credit (no pun intended), 700Credit has taken several proactive steps:

Consumer Notifications:

- Branded with 700Credit's name and phone number (not dealers') to protect dealership reputations

- Includes detailed explanation of the incident

- Provides timeline (May–October 2025)

- Offers steps consumers can take to protect themselves

Credit Monitoring Services:

- 12-24 months of free identity and credit monitoring (varies by state requirements)

- Consumer helpline: (833) 586-1820

- Dealer helpline: (866) 273-0345

Regulatory Compliance:

- Consolidated FTC filing (accepted by the FTC)

- State Attorney General notifications

- FBI notification

- Working with NADA on dealer support

Why This Breach Is Different (And More Dangerous)

It's a Vendor Risk Nightmare

Remember: Dealerships didn't do anything wrong. Their systems weren't compromised. Yet they're still responsible for customer notifications, regulatory compliance, and potential liability.

This is EXACTLY why the FTC Safeguards Rule requires:

- Comprehensive vendor risk assessments

- Vendor security requirements in contracts

- Annual vendor security reassessments

- Data Processing Agreements (DPAs)

The Timing Couldn't Be Worse

This breach comes just as:

- PCI DSS 4.0.1 compliance deadline approaches (March 31, 2025)

- FTC enforcement of Safeguards Rule intensifies

- State privacy laws expand

- Automotive industry faces heightened scrutiny after multiple major breaches

Protecting Your Dealership's Reputation

Your customers are scared and angry. Here's how to manage the damage:

Communication Strategy:

1. BRIEF YOUR TEAM

- Sales staff will get questions—prepare them

- F&I managers need talking points

- Receptionists need to know how to route calls

2. PREPARE YOUR MESSAGE

- Acknowledge the breach came from a vendor

- Emphasize: NO DEALERSHIP SYSTEMS WERE COMPROMISED

- Point customers to 700Credit's helpline: (833) 586-1820

- Highlight the free credit monitoring available

- Reassure them you're taking additional security measures

3. USE THIS AS A CUSTOMER CARE MOMENT

The dealerships that handle this well will actually STRENGTHEN customer relationships by demonstrating they care about data protection.

The Bigger Picture: Vendor Risk Is Your Risk

Other Recent Automotive Vendor Breaches:

- CDK Global (2024): 15,000+ dealerships, operations shut down for weeks

- Reynolds & Reynolds: Prior incidents affecting thousands

- Third-party integrations: Constant targets

THE PATTERN IS CLEAR: You can have perfect internal security and still be devastated by a vendor breach.

What Dealerships Must Do Going Forward

1. UPDATE YOUR INFORMATION SECURITY PROGRAM

Document:

- This breach incident and its causes

- Lessons learned

- Enhanced monitoring of 700Credit (or alternative vendors)

- Updated risk assessment findings

- Actions taken to prevent similar incidents

2. ENHANCE VENDOR MANAGEMENT

For ALL vendors with customer data access:

- ✅ Request current SOC 2 reports

- ✅ Review security certifications

- ✅ Require penetration testing documentation

- ✅ Get cyber insurance verification

- ✅ Include indemnification clauses in contracts

- ✅ Conduct annual security reassessments

3. REVIEW YOUR CONTRACTS

Check your 700Credit contract for:

- Indemnification provisions

- Breach notification responsibilities

- Liability limitations

- Security requirements

Consider formal notice to 700Credit seeking indemnification for costs and liabilities arising from this breach.

4. DOCUMENT EVERYTHING

Create a complete file including:

- All communications with 700Credit

- Consumer notices sent

- Insurance notifications

- Vendor assessments

- Internal response actions

This documentation is CRITICAL for:

- FTC Safeguards Rule compliance audits

- Insurance claims

- Potential litigation defense

- Demonstrating due diligence

5. UPDATE YOUR ANNUAL BOARD REPORT

Your Safeguards Rule-required Board Report should include:

- Description of this incident

- Impact on customers

- Response actions taken

- Preventive measures implemented

- Vendor risk management enhancements

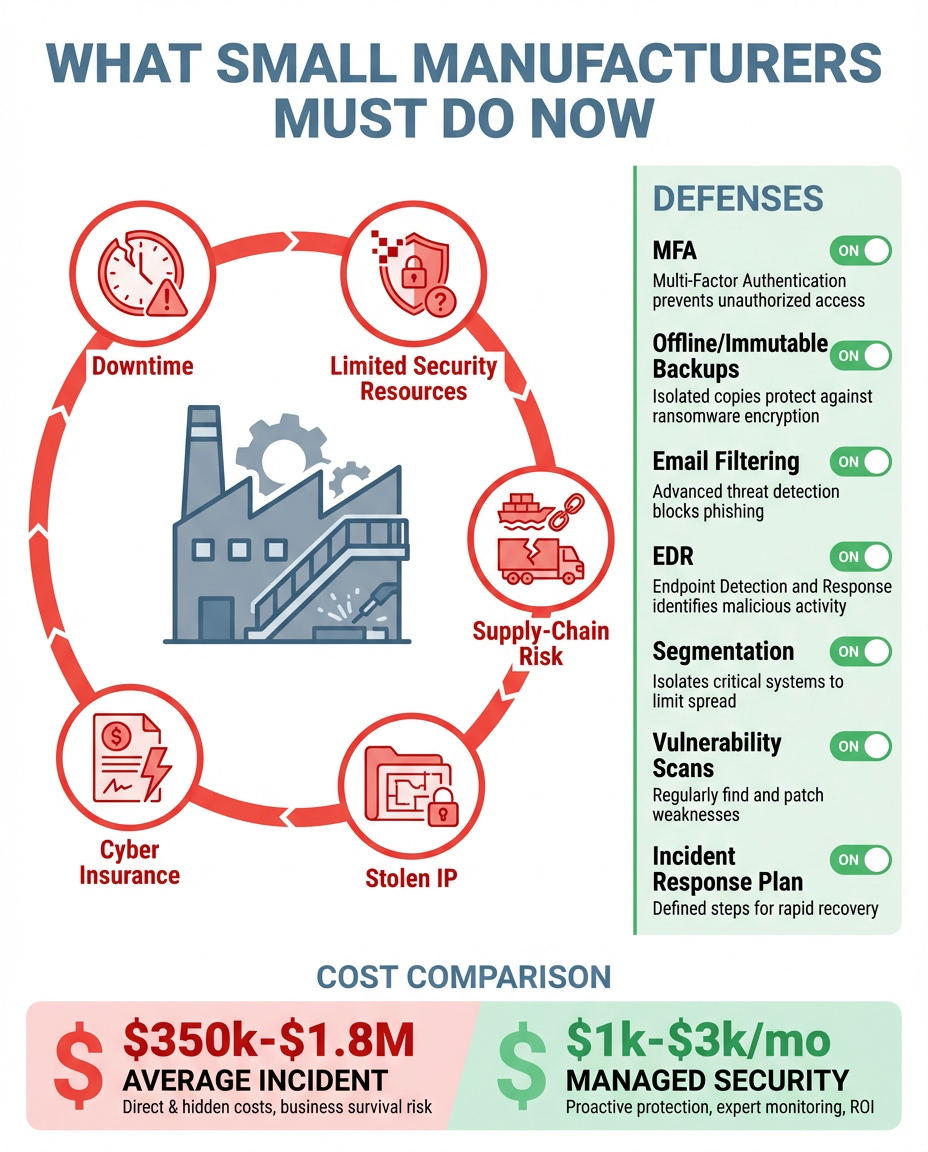

The Hard Truth About Compliance Costs

Yes, robust cybersecurity and vendor management programs are expensive. But consider the alternatives:

Direct Costs of This Breach:

- Consumer notifications: $$$ per affected customer

- Credit monitoring services: 12-24 months per consumer

- Legal fees: Ongoing and unpredictable

- Regulatory penalties: Potentially massive

- Staff time: Hundreds of hours

Indirect Costs:

- 💔 Customer trust and reputation damage

- 📉 Lost sales from concerned customers

- ⚖️ Potential class-action lawsuits

- 🔍 Increased regulatory scrutiny

- 📋 OEM compliance audits

THE DEALERSHIPS THAT INVESTED IN PROPER VENDOR RISK MANAGEMENT are navigating this crisis far more smoothly than those who cut corners.

Are You Prepared for the Next Breach?

Because there WILL be a next breach. The question isn't "if," it's "when"—and whether YOUR dealership will be ready.

Critical Questions to Ask Yourself:

- Do you have current risk assessments for ALL vendors with customer data access?

- Do your vendor contracts include required security provisions and indemnification?

- Is your Information Security Program documented and up to date?

- Have you conducted required security awareness training?

- Do you have a documented incident response plan?

- Is your cyber insurance current and adequate?

- Can you prove compliance with the FTC Safeguards Rule?

IF YOU ANSWERED "NO" OR "I'M NOT SURE" TO ANY OF THESE, you're at risk.

The Silver Lining

Smart dealerships are using this incident as a wake-up call to:

- ✅ Strengthen vendor management programs

- ✅ Enhance security awareness training

- ✅ Review and upgrade cyber insurance

- ✅ Demonstrate security commitment to customers

- ✅ Turn compliance into a competitive advantage

REMEMBER: In an industry plagued by data breaches, the dealership that can credibly say "we take data security seriously" has a POWERFUL DIFFERENTIATOR.

DON'T WAIT FOR THE NEXT BREACH

The 700Credit breach proves that even vendors you trust can put your business at risk. The time to strengthen your cybersecurity and compliance posture is NOW —before the next incident occurs.

ALLTECH IT SOLUTIONS SPECIALIZES IN AUTOMOTIVE DEALERSHIP COMPLIANCE

We help dealerships like yours navigate:

- ✅ FTC Safeguards Rule compliance

- ✅ PCI DSS 4.0.1 requirements

- ✅ Vendor risk assessment and management

- ✅ Data breach response and recovery

- ✅ Comprehensive cybersecurity protection

- ✅ Staff security awareness training

We understand the unique challenges automotive dealerships face—and we have proven solutions that work.

Get Your Free ConsultationCONTACT ALLTECH TODAY FOR A FREE COMPLIANCE GAP ANALYSIS

Don't let the next vendor breach destroy your reputation and bottom line. Let AllTech help you build the security infrastructure and compliance framework your dealership needs to thrive in 2025 and beyond.